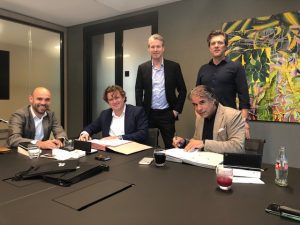

Claeren and Taylor Mates have decided for the future to use only one trade

One trade, one company name, “Claeren”.

Besides that nothing changed. Still two locations in the south of The Netherlands an working with a team of 70 committed colleagues.

Claeren, We’ve got you covered

Taylor Mates chooses for Claeren Advies Groep

Taylor Mates chooses for Claeren Advies Groep

We are becoming older and older. This has consequences for the pensions. That is why the pensiondate is increasing from 67 to 68 years. The increase of the pensiondate has consequences fort the employer and employee.

We are becoming older and older. This has consequences for the pensions. That is why the pensiondate is increasing from 67 to 68 years. The increase of the pensiondate has consequences fort the employer and employee.

Pension funds will again not indexing benefits to inflation because of low interest rates.

Pension funds will again not indexing benefits to inflation because of low interest rates. Aegon has sold its portofolio general business insurances business to Allianz Benelux. Aegon continues with private insurance and income protection insurance in the Netherlands. The transition means that there is a premium volume of over € 90 million to Allianz Benelux

Aegon has sold its portofolio general business insurances business to Allianz Benelux. Aegon continues with private insurance and income protection insurance in the Netherlands. The transition means that there is a premium volume of over € 90 million to Allianz Benelux The system to finance the long term disabled employees will be

The system to finance the long term disabled employees will be